President Biden’s administration aims to achieve tax fairness by empowering the IRS with more resources, but critics argue that the IRS’s focus on auditing low-income Americans instead of the wealthy raises questions about its effectiveness and fairness.

IRS Audits Raise Fairness Concerns – Critics Question Targeting of Low-Income Areas Despite Biden’s Tax Equity Goals

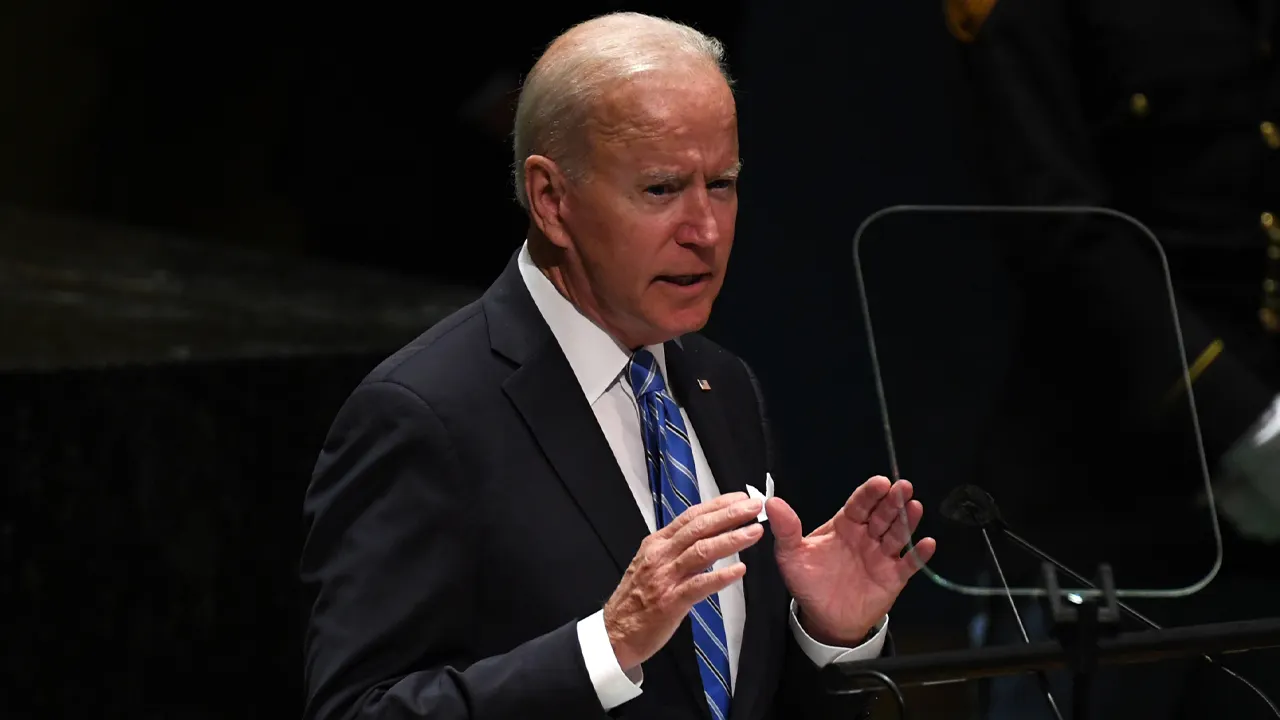

As per the article in Washington Examiner, President Joe Biden’s administration believes in making taxes fairer for all Americans by giving more support to the IRS. They argue that this will help ensure everyone pays what they owe. However, critics argue that these efforts have not been effective. Biden emphasizes the importance of wealthy individuals paying their fair share, but there’s concern that the IRS is disproportionately auditing low-income Americans rather than focusing on higher-income earners.

When you look at where the IRS audits happen most, it’s surprising. Big cities with lots of rich people aren’t the main targets. Instead, places like Humphreys County, Mississippi, where many people are poor, get IRS audited the most. This has raised questions about whether the IRS is being fair in how it chooses who to audit. Minorities and low-income people are audited more often, which adds to concerns about fairness.

READ ALSO: 85% Of Taxpayers Warned: Beware Of IRS-Targeted Scams And Fraudulent Fake Clean Energy Tax Credit Claims

70% of IRS Audits Target Low-Income Americans – Raising Fairness Concerns Amid Biden’s Tax Equity Goals (PHOTO: Fox Business)

IRS Faces Backlash Over Data Mishandling and Unfair IRS Audits Amid Calls for Greater Oversight

Many people are concerned that the IRS, which has been criticized for mishandling sensitive taxpayer information and unfairly targeting certain political groups, might increase audits on small businesses and struggling families if given more power. As discussions about taxes and fairness unfold, there’s a growing skepticism about whether the IRS is truly serving the best interests of the people it aims to safeguard.