Student loan borrowers in the US may soon see reduced monthly payments through the SAVE plan despite ongoing legal challenges, with the Biden administration also proposing broader debt relief measures to address high education costs and financial burdens.

New SAVE Plan Offers Potential Half Reduction in Student Loan Payments Amid Ongoing Legal Challenges

According to the Los Angeles Times, student loan borrowers in the United States might see their monthly payments cut in half with a new plan called the Saving on a Valuable Education (SAVE) plan. However, ongoing legal battles are confusing for many borrowers. A recent court decision allows the plan to continue for now, but its long-term future is uncertain. Borrowers should check studentaid.gov and talk to their loan servicers for updates.

The SAVE plan aims to make payments easier by basing them on borrowers’ income instead of the amount borrowed. It promises lower payments, especially for undergraduate loans, by reducing the repayment rate to 5% of discretionary income. Despite these benefits, the plan has faced challenges from Republican officials in several states. A federal judge temporarily blocked the reduced rate, but an appeals court has paused that decision, letting the Education Department continue offering relief.

READ ALSO: £1.2 Billion Payouts At Stake: HMRC Clarifies Tax Code Changes Affecting State Pension Payments – Ensuring Fairness For Retirees

$10 Billion in Relief at Stake: New Student Loan Repayment Plan Faces Legal Challenges (PHOTO: Reuters)

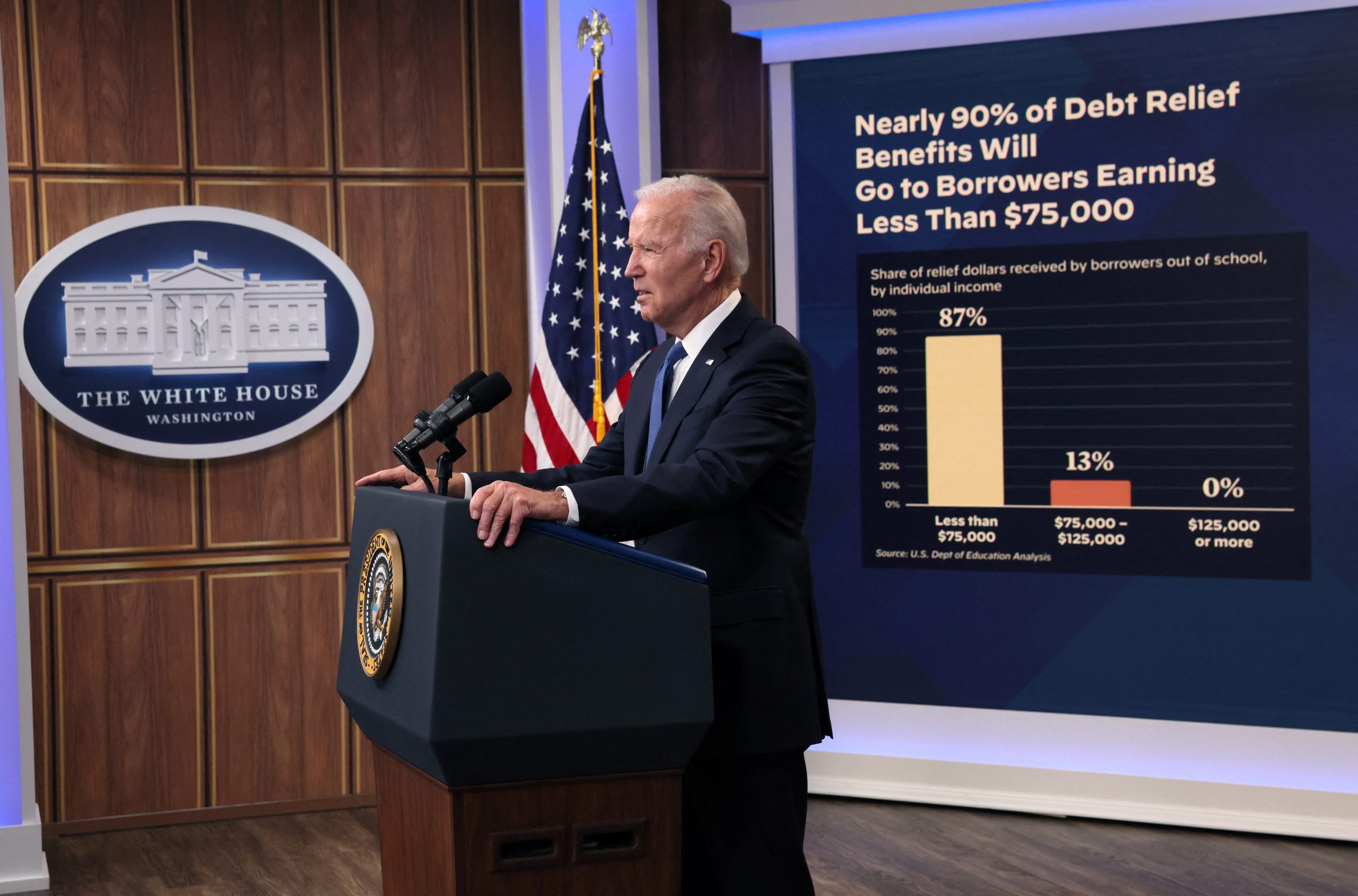

Biden Administration‘s Debt Relief Proposals Spark Debate Over College Cost Burden

The Biden administration is also working on other ways to help borrowers. They propose canceling debts for those who have been repaying loans for 20-25 years and reducing unpaid interest charges. While many people support these efforts, some oppose them, saying it’s unfair to shift college costs onto taxpayers. The administration’s push for debt relief highlights the struggle to manage high education costs and the financial burden on borrowers.