A decline in the purchasing power of American paychecks helped put Donald Trump back in the Oval Office.

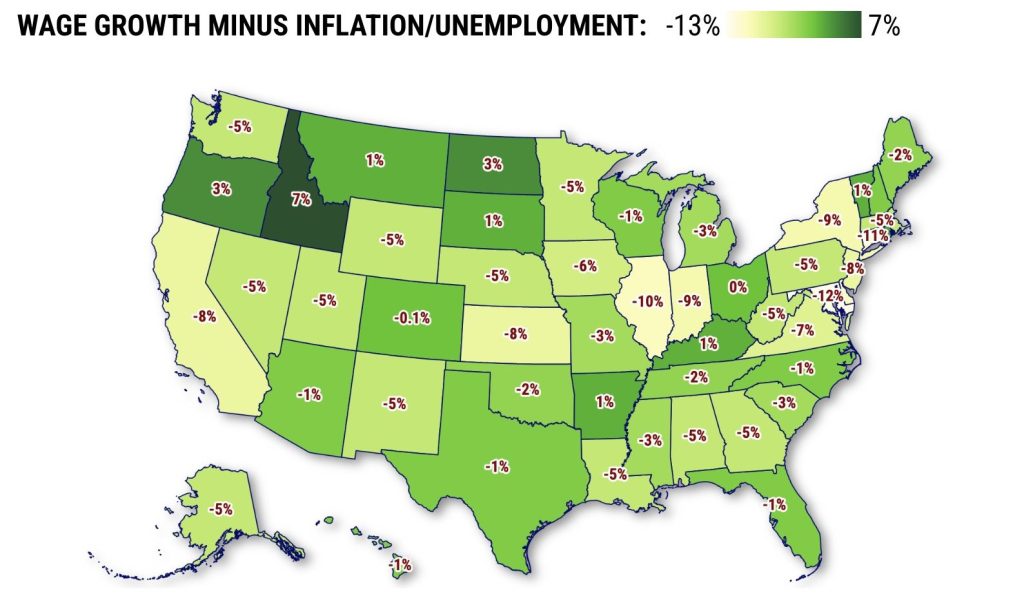

To gauge the economic slice of the Trump victory over Kamala Harris, my trusty spreadsheet crafted a paycheck power index. It combined three key business yardsticks for the 50 states and the District of Columbia – eight years of average weekly wages paid by private industry bosses, unemployment rates, and nationwide inflation as measured by the Consumer Price Index.

Pay hikes were measured against joblessness to approximate how many people got wage boosts. Those raises were then discounted by the rising cost of living.

Next, to create a national index with voting in mind, purchasing power results were weighted by a state’s electoral college votes. That gave this yardstick, like the presidential election, a touch of small-state favoritism. Here is how this metric worked.

- REAL ESTATE NEWSLETTER: Get our free ‘Home Stretch’ by email. SUBSCRIBE HERE!

First, note that in the four years ending in September – roughly measuring President Biden’s economy, a track record politically tied to Harris, his vice president – a typical US paycheck grew 17%. That was slightly better than the 14% increase in the previous four years of the Trump presidency.

Second, the Biden/Harris unemployment rate averaged 4.2% vs. 4.8% in the Trump years.

Finally, and perhaps the election-turning factor, consumer prices rose 21% during the past four years vs. an 8% gain in the previous four.

So when you combine these three measurements, adjusted for the Electoral College’s oddities, the paycheck power index declined 4% in the Biden/Harris era after rising 5% under Trump.

That’s no small gap. Exit polling shows us that one-third of voters said the economy was their top issue – with 80% of pocketbook-antsy folks voted for Trump.

Pay swing

Now, let’s consider the index where presidential elections are actually decided – at the state level.

When comparing these periods, a typical paycheck’s buying power grew in just two states: Idaho and North Dakota. No matter the economy, liberal Harris never had a chance in either conservative state.

Yet, consider the drops in this salary benchmark for 2024’s seven swing states – all apparently won by Trump.

Nevada: Purchasing power fell 5% during the last four years vs. a 9% gain in the previous four. That’s the eighth-largest downswing among the states.

Arizona : Off 1% last four years vs. previous 8% gain. The 26th biggest gap.

Georgia: Off 5% last four years vs. previous 3% gain – No. 27.

Michigan: Off 3% last four years vs. previous 4% gain – No. 32.

- INFLATION TRENDS: What’s up? What’s cheaper? What’s next? CLICK HERE!

Pennsylvania: Off 5% last four years vs. previous 2% gain – No. 31.

Wisconsin: Off 1% last four years vs. previous 4% gain – No. 38.

North Carolina: Off 1% last four years vs. previous 4% gain – No. 40.

Caveat

Now, ponder buying power’s shrinkage in three giant economies with very differing political preferences. Pocketbooks clearly didn’t sway every voter.

In California, paycheck power declined 8% in the last four years vs. a 9% gain in the previous four. That fourth-largest gap did not stop Harris from easily winning the state.

Meanwhile, the Texas pay index was down 1% in the last four years vs. being up 1% previously, the fourth-mildest slide. And Florida’s recent 1% dip compared with a 6% increase in 2016-20, the 17th-best performance.

Still, this pair of states easily went for Trump.

Bottom line

In a previous column, I noted that inflation and the job market were historically accurate predictors of presidential elections. The only problem this year was they pointed in opposite directions: jobs favoring Harris while inflation favored Trump.

Harris and her supporters campaigned that the economy was performing admirably. My paycheck index tends to agree.

- HIRING TRENDS: Who’s adding workers? Where are the layoffs CLICK HERE!

Think about the recently completed third quarter. US weekly wages grew at a 3.2% annual rate, off slightly from the 3.6% average since 2016. Meanwhile, unemployment ran 3.9% vs. at 4.5% norm.

And pesky inflation cooled, growing at a 2.6% annual rate vs. a 3.4% eight-year average.

That left my paycheck power index up 0.4% for the quarter. That was the first boost in purchasing power for American workers since the start of 2021.

So was that upswing too little, too late? Was the economy not a relevant issue for undecided voters?

Or were many Americans unwilling to forgive the holes in their wallets created by what had been the worst inflationary spike in four decades?

Jonathan Lansner is the business columnist for the Southern California News Group. He can be reached at [email protected]