Jackson County homeowners are advised to apply now for Missouri’s updated senior property tax freeze program, despite confusion over a state order to lower last year’s high property values, as tax bills are expected to remain stable this year and the program now includes more seniors with simplified rules.

Jackson County Seniors Advised to Apply Now for a Property Tax Freeze Despite State Order on Property Values

According to The Kansas City Star, recent changes to Missouri’s senior property tax freeze program have left Jackson County homeowners with questions about how to apply. The updated rules make more seniors eligible for the tax freeze, but there’s confusion over whether to wait due to a recent state order that tells the county to lower last year’s high property values. Jackson County officials say they won’t change last year’s values and advise seniors to apply for the tax freeze program now, rather than wait for a potential refund.

This year, Jackson County homeowners should expect their property tax bills to stay about the same as last year since property values won’t be reassessed until 2025. The tax freeze program should keep future tax bills steady for those who qualify. Jackson County plans to challenge the state’s order in court but still encourages eligible seniors to apply for the tax freeze now.

READ ALSO: $50 Billion Drug Price Crisis: States Turn to Lawsuits Against PBMs to Lower Costs

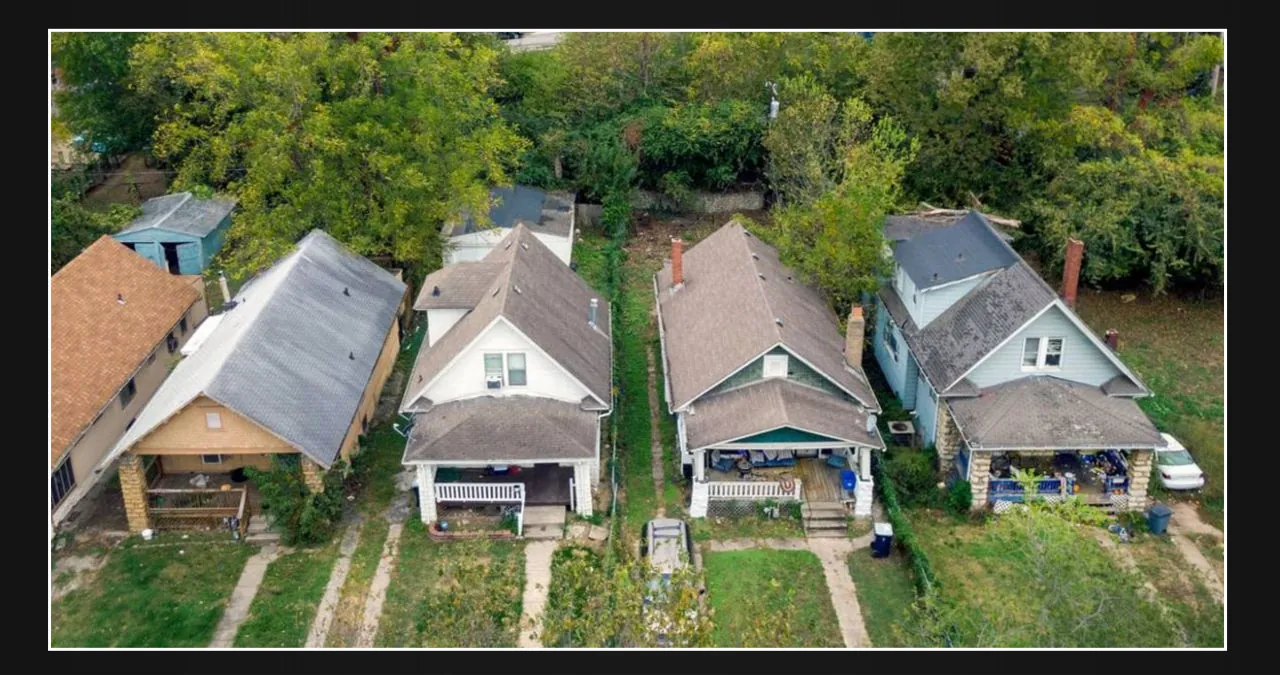

62% of Missouri Seniors Eligible for Tax Freeze Program: Jackson County’s New Guidelines and Application Process Explained (PHOTO: Brady Today)

Jackson County’s Senior Property Tax Freeze Program: New Rules, Application Review Begins in September

Applications for the senior property tax freeze program will start being reviewed in September and processed as they come in. Homeowners who applied earlier this year don’t need to reapply, as all applications will be judged under the new rules. The program now includes all homeowners aged 62 and older, removes the old home value cap, and doesn’t require yearly reapplications. Applications are open until December 31, with updates on approvals expected in early 2025.

READ ALSO: Fed’s Rate Cut Alert: What’s Next for the Economy and Election?