Fraudulent Activities Target Unclaimed MCTR Funds

Challenges in Claiming MCTR Funds

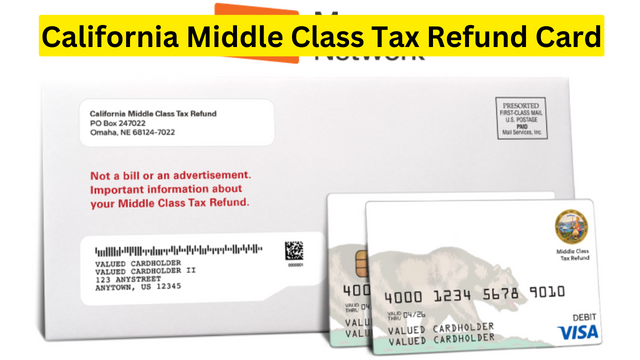

According to MARCA, the Middle-Class Tax Refund (MCTR) was introduced in 2022 to mitigate inflation’s effects. However $611 million in refunds, ranging from $200 to $1000 per person has yet to be claimed. Despite efforts by the California Franchise Tax Board (FTB) to prompt recipients to activate their MCTR cards or update their information many eligible individuals have not accessed their funds. This is primarily due to issues like outdated addresses or incomplete banking details which have prevented them from receiving their rightful refunds.

The unclaimed MCTR funds have also attracted fraudulent activities with approximately one percent of the total amount falling victim to hackers seeking easy cash. Eligibility for the MCTR was based on timely filing of 2020 tax returns and meeting specific income criteria set for that year. However individuals facing obstacles like outdated personal details may find it difficult to complete the necessary steps to secure their refunds. Despite these challenges the FTB continues to emphasize the importance of accurate information and proactive measures to ensure eligible residents receive their financial relief.

READ ALSO: 3 Dead, 2 Injured In East Village Stabbing Spree: ‘Open Air Drug Market’ Concerns Ignored For Too Long, Say Residents And Officials!

$611 Million in Unclaimed California Tax Refunds: Don’t Miss Out on Your Share – Claim Your MCTR Today! (PHOTO: NCBlpc)

Ensuring Equitable Distribution of MCTR Funds

The situation with the unclaimed MCTR funds underscores the importance of timely action and accurate information in claiming tax refunds. It also highlights ongoing challenges in managing fraud risks associated with large-scale payment distributions. As California continues efforts to urge eligible residents to claim their MCTR refunds ensuring fair and efficient distribution of financial assistance remains a priority. By addressing barriers to access and enhancing outreach efforts the state aims to provide necessary relief to individuals impacted by economic pressures exacerbated by inflation and other economic factors.

Tax refunds in the United States including initiatives like the MCTR are meant to return excess tax payments to taxpayers. This surplus occurs when the amount withheld from paychecks or paid in estimated taxes throughout the year exceeds the actual tax liability determined during annual tax filings. Credits such as the Earned Income Tax Credit (EITC) and Child Tax Credit (CTC) also contribute significantly to refunds providing crucial financial support to eligible families and individuals. These refunds are essential for easing financial burdens and promoting economic stability nationwide.