Federal judges in Kansas and Missouri have temporarily halted parts of President Biden’s SAVE student loan repayment plan.

Federal Judges Block Biden’s SAVE Student Loan Repayment Plan Temporarily

Federal judges in Kansas and Missouri have temporarily blocked parts of the Biden administration’s SAVE student loan repayment plan. This initiative designed to lower monthly payments and expedite debt forgiveness faces legal challenges from Republican-led states arguing that it exceeds presidential authority.

The injunctions, issued Monday, prevent further cancellation of federal student debt for those enrolled in SAVE until the lawsuits are resolved. Currently, the program has forgiven $5.5 billion in debt for 414,000 borrowers who have made at least 10 years of payments.

White House press secretary Karine Jean-Pierre criticized the rulings but affirmed the administration’s commitment to helping students. The Department of Justice will defend the SAVE plan in court indicating the administration’s determination to support borrowers despite legal obstacles, according to the report of CNN.

Following the Supreme Court’s rejection of Biden’s previous student loan forgiveness efforts, the SAVE plan emerged as a key policy. It adjusts payments based on income and family size benefiting millions especially low-income borrowers who may pay nothing monthly.

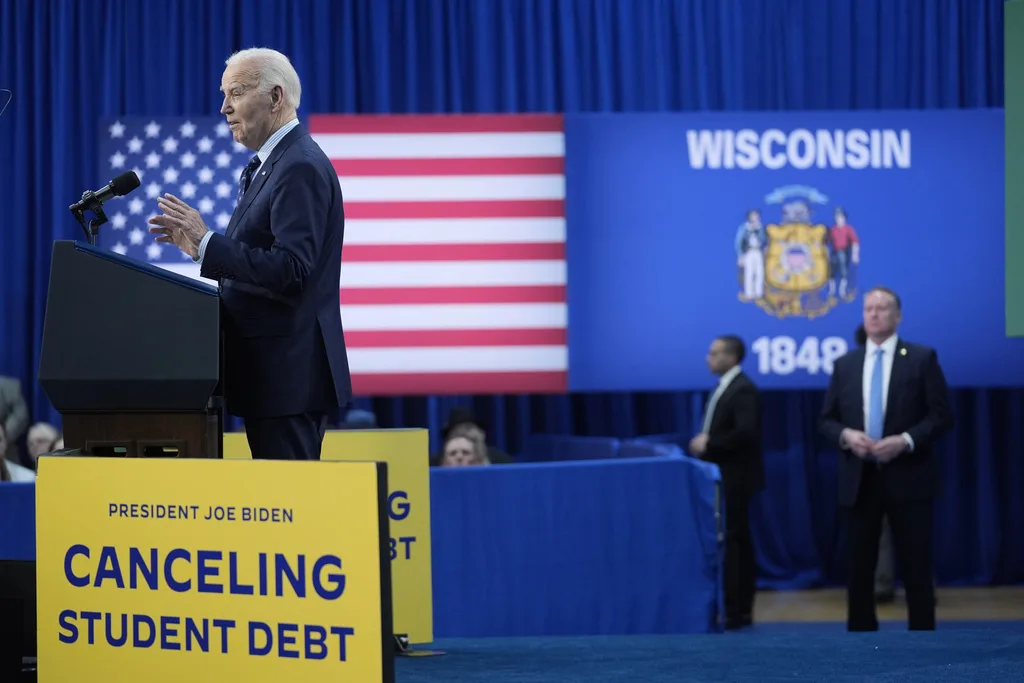

(photo: Queen City News)

Legal Challenges Question Biden’s SAVE Plan Authority Amidst Student Loan Relief Efforts

Legal challenges focus on whether the administration exceeded its authority by implementing SAVE without Congressional approval. Critics argue the plan effectively turns loans into grants, raising fiscal concerns without clear legislative backing.

For now, borrowers in SAVE can continue under current terms, though anticipated payment reductions in July may be delayed pending court decisions. Uncertainty looms over the administration’s efforts to ease student debt burdens amidst ongoing legal battles.

As lawsuits unfold, the fate of the SAVE plan remains unclear, impacting millions awaiting clarity on repayment terms and potential debt relief. The legal dispute highlights broader debates over executive versus legislative authority in shaping federal student loan policies.

READ ALSO: $1.4M Homes In 2030: A Glimpse Into The Soaring US Housing Market Forecasts – Must Know!