The Department of Education has given more time to apply for student loan forgiveness, letting people combine their loans into one to make payments easier and possibly get debt relief.

Department of Education Extends Loan Forgiveness Deadline, Simplifies Debt Management with Consolidation

According to the published article by Market Realist, the Department of Education has made it easier for young people to manage their student loan debt by extending the time to apply for loan forgiveness programs. These programs, including new ones from the White House, help by allowing borrowers to combine certain federal loans. By consolidating loans like FFELP and Perkins into Direct Loans, people can qualify for benefits like loan cancellation and interest forgiveness. This process makes managing debt easier by turning multiple loans into a single monthly payment.

Student loan consolidation means combining multiple federal student loans into one new loan with a fixed interest rate. This can make borrowers eligible for income-driven repayment (IDR) plans and forgiveness programs. If someone has been making payments for 20 to 25 years under an IDR plan, their entire debt could be forgiven. Consolidating loans can lower monthly payments, but it might also extend the repayment period. The new interest rate will be a weighted average of the old rates, rounded to the nearest 1/8th of a percent, so interest rates shouldn’t increase much.

READ ALSO: 3.2 Million Californians: State Senate Moves Forward With Ambitious Reparations Proposals – Leaving Some Advocates Frustrated!

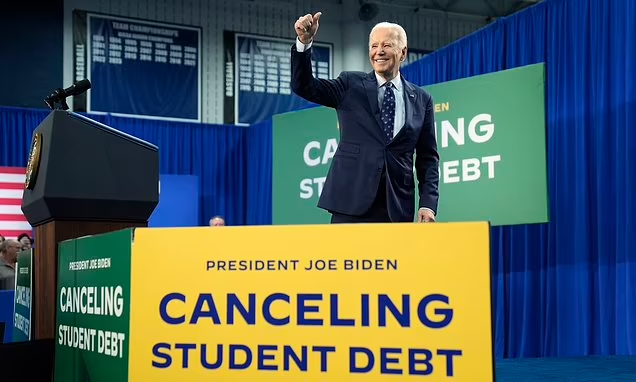

$100 Billion in Student Loan Debt Relief: Department of Education Extends Application Deadline to June 30 – Must Know! (PHOTO: Business – Time)

How to Apply for Student Loan Consolidation on StudentAid.gov Before June 30 Deadline

Furthermore, to consolidate student loans, borrowers need to visit StudentAid.gov and complete the application before June 30. The application takes about 30 minutes and requires a Federal Student Aid ID, personal and financial information, and loan details. It can take up to 60 days to process the consolidation, during which time the loan payment count may temporarily reset to zero. This indicates that the consolidation is being processed, making it easier to manage debt and potentially qualify for loan forgiveness.