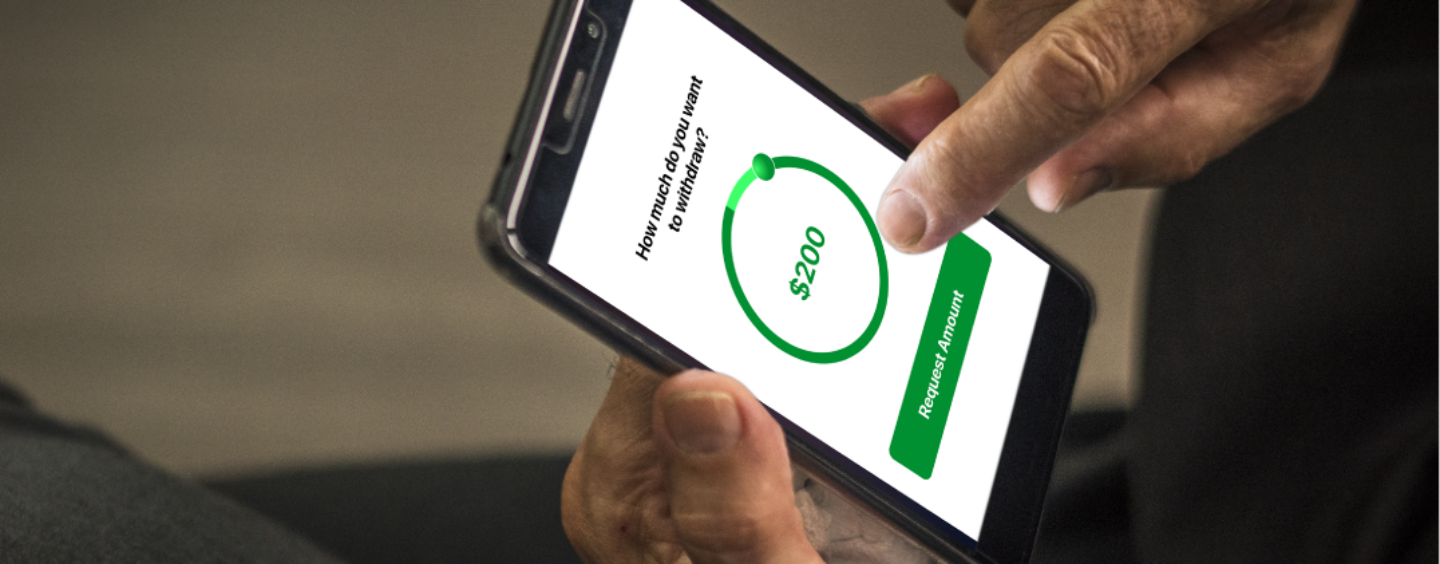

The Dual Nature of Earned Wage Access Surge in Earned Wage Access Users

Earned Wage Access Users Caught in a Cycle

According to The Grio, Earned Wage Access apps are like quick-money helpers for Americans who need cash before their paycheck arrives. Anna Branch tried one when her work hours got cut, and it helped her pay bills until payday. Sheri Wilkins, feel like they can’t stop using these Earned Wage Access apps even though they end up paying a lot in fees. Critics say these Earned Wage Access apps are like modern payday loans because they charge high fees and can keep people stuck in debt.

Some users, like Andrew Lewis feel guilty about the extra money they have to pay in tips when they use these Earned Wage Access apps. They wonder if their tips are really helping others or just making the Earned Wage Access app companies richer. Even though Earned Wage Access can be convenient it’s causing problems for many people. They end up paying more in overdraft fees and some lawmakers want to make rules to protect them from getting trapped in debt. It’s a big issue that needs to be fixed soon.

READ ALSO: 90,000 Older Adults To Benefit From Tax Credit Relief – Colorado House Passes Bill To Aid Seniors Struggling With Housing Affordability!

Surge in Earned Wage Access Users: Are Modern Quick-Money Apps Becoming a Debt Trap (PHOTO: Fintech News Singapore)

The True Price of Early Access to Paychecks

Moreover, Earned Wage Access apps might seem helpful but they can actually make money problems worse. People who use these Earned Wage Access apps often end up paying a lot in fees. This can make it really hard for people to save money. They worry that their extra money isn’t really helping anyone. This makes using these apps stressful. More and more people are talking about these issues and they want lawmakers to make rules to make these apps fairer for everyone.