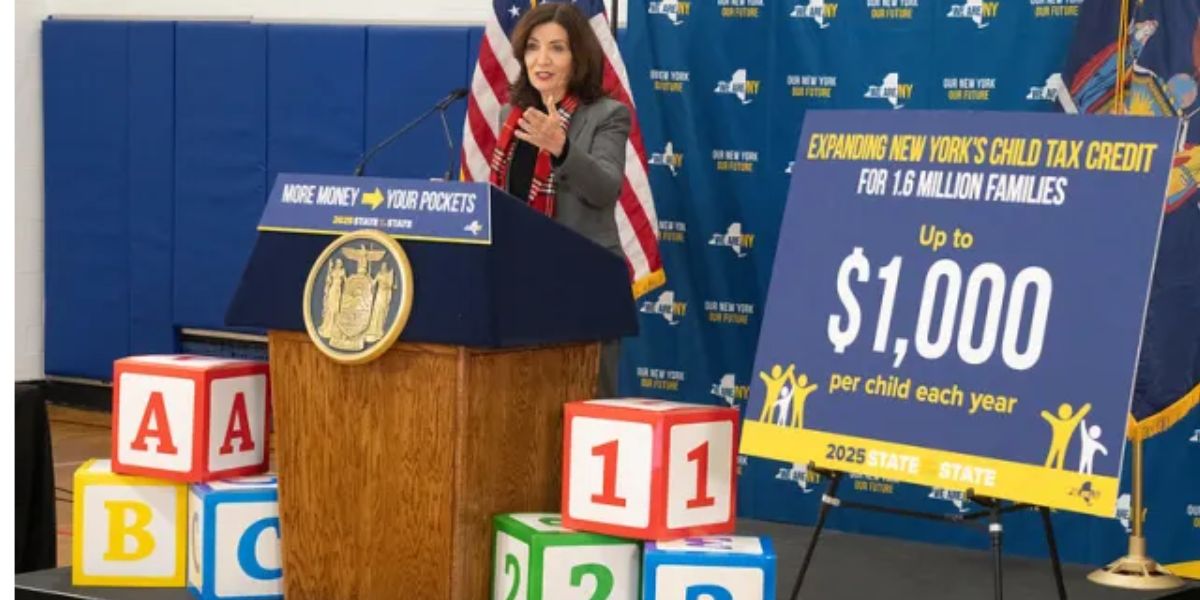

WPBN: The cost of raising a child in New York is high. Expenses go up rapidly, from diapers to school fees, and many families experience financial strain. In an effort to lessen that cost, Governor Kathy Hochul has proposed expanding the child tax credit.

The existing support of $330 per child would be increased to a maximum of $1,000 for children under 4 and $500 for those between 4 and 16 if this proposal is accepted.

It’s a big adjustment. Official estimates suggest that the average amount of aid that families receive might increase from $472 to $943 annually.

Why is the child tax credit expansion required?

The cost of living in New York is high. incredibly costly. Additionally, basic costs like food and clothing can become a daily struggle for families with little children. “I know how hard it is to make ends meet with kids at home,” Hochul said plainly. As a governor and mother, I want to provide some respite to working families.

This plan seeks to lower the cost of raising children in New York while also showing support for the most disadvantaged households.

How is this increase going to be implemented?

From low-income families to upper-middle-class families, the initiative is intended to help a broad spectrum of families. For instance:

A family earning up to $110,000 year with two children, including a preschool-aged child, may be eligible for $1,500 in tax credits annually. In comparison to the current program, this is an increase of almost $1,000.

Families with greater incomes, such as a couple making $170,000 year, might also profit. More than $500 would be given to them, which was not feasible under the existing regulations.

The increase of credit won’t occur all at once. It will be put into effect over the course of two years in phases:

- Fiscal Year 2025: The extended $1,000 credit will initially be given to families with children under the age of four.

- Fiscal Year 2026: The $500 credit will be available to households with children ages 4 to 16.

Furthermore, this help will be reimbursed. What does this signify? that you will get a direct refund for any difference between the credit and the taxes you owe. Put another way, even if your taxes are low, you won’t lose the money.

FEMA to Evict 3,000 Families from Hotels in Carolinas Amid Oncoming Snowstorm

How will families be affected?

This initiative will be a lifeline for many families. Let’s consider a household where each child currently receives $330. The additional money from this raise could be used for winter clothing, school supplies, or even emergency medical savings.

Further security is provided by the fact that it is refundable. The additional funds will serve as a safety net for families in the event of a medical emergency or other financial hardship, such as a layoff.

Social Security Administration to Issue Two More SSDI Payments in January 2025

A move in the direction of a more economical future

With this idea, New York is making a strong statement: families’ welfare comes first. In addition to helping with everyday expenses, the expansion of the child tax credit seeks to improve the state’s child-rearing environment.

Thousands of households may be greatly impacted by New York’s possible child tax credit expansion. Families will be better equipped to handle the financial strain of raising children if they are granted approval.

Keep yourself updated on any new developments, and if you qualify, don’t forget to use this help. Actions like these can make a big difference between a family budget that is too tight and one that is easier to manage.

REFERENCE