By Eliza Haverstock | NerdWallet

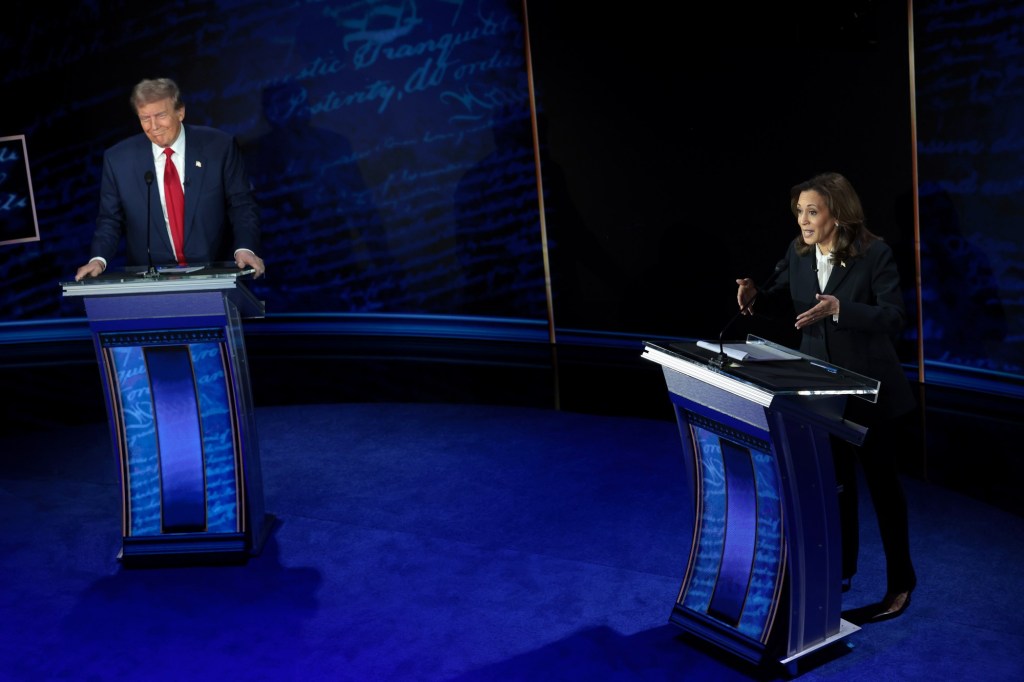

As the Nov. 5 election looms, Vice President Kamala Harris and former President Donald Trump offer starkly different visions for student loan policy at a time when the topic is top of mind for voters.

More than one in five student loan borrowers (22%) say that student loan forgiveness is one of the most important issues when choosing a presidential candidate, according to a recent NerdWallet survey conducted online by The Harris Poll. Both parties are thinking about the issue: 43% of Democrats and 30% of Republicans say student loan repayment will impact their vote, per the recent 2024 EdAssist by Bright Horizons Education Index.

The official Democratic and Republican platforms, along with past statements, actions and related policy documents, indicate how each candidate may approach student loans if elected to the White House.

Harris and her running mate, Minnesota governor Tim Walz, would likely continue to champion the student loan efforts started under President Biden, who has erased $168.5 billion in student loan debt for 4.76 million borrowers while in office. His administration did so largely by improving existing student loan forgiveness programs.

If Trump and his vice president pick, Ohio senator JD Vance, win the White House, borrowers can expect a reigning in of relief and forgiveness programs.

“On the Trump side, this is someone who, as president, consistently proposed big cuts to all federal education funding, but especially to programs that would help students and student loan borrowers,” says Michelle Dimino, director of education at the center-left think tank Third Way. “On the Harris side, we have a history of supporting increases for Federal Student Aid and consumer protections for borrowers.”

(Neither campaign responded to multiple NerdWallet requests to comment on their student loan positions.)

Project 2025, a 900-page playbook for the next Republican president overseen by the conservative Heritage Foundation, also offers clues about what a Trump presidency could mean for student loan borrowers, even though Trump’s campaign has tried to distance itself from the document.

“It’s still very much put forward as a Republican Party conservative viewpoint on education, and so I think it includes a lot of policy proposals that there would be a lot of lobbying to get a potential Trump administration to implement,” says Katharine Meyer, a fellow in the Governance Studies program for the Brown Center on Education Policy at Brookings, a nonpartisan think tank.

From repayment plans and loan forgiveness to affordable degrees and community college, here’s where Harris and Trump stand on issues impacting student loan borrowers.

Broad student loan forgiveness

Biden’s “plan B” for broad student loan forgiveness is currently facing legal blowback from Republican-led states. It could be months before borrowers have a decision, and the outcome is largely dependent on the courts, independent of November’s election results.

However, an incoming presidential administration still has power to sway the effort in their desired direction and to drive the appeals process, Dimino says.

“I think certainly a Harris administration would be working to continue to defend that effort for as long as they can, continuing the appeals process and being as aggressive as they can be to safeguard that,” she says.

Trump would most likely not support the forgiveness plan, echoing the Republican party’s opposition to student loan forgiveness. Republican-led states filed lawsuits that took down Biden’s original student loan forgiveness plan of up to $20,000 per borrower in 2023, along with lawsuits currently circling the SAVE repayment plan and Biden’s forgiveness “plan B.”

“In the past, [Trump] has been supportive of student loan cancellation. It was in his campaign eight years ago, which was really inconsistent with the Republican Party’s platform at that time,” says Beth Akers, senior fellow focused on the economics of higher education at the American Enterprise Institute, a center-right think tank. “Things have changed a lot since then, and I would anticipate that a Trump presidency would not be pushing on continuing to use any existing authorities to cancel student debt, instead maybe a reining in of the programs, working potentially with lawmakers on Capitol Hill to create some of the reforms that conservatives now think are necessary in order to get the student loan program back into a functional state.”

SAVE and other income-driven repayment plans

Like Biden’s forgiveness plan B, the SAVE repayment plan faces lawsuits, with its future largely dependent on the courts. However, if elected, Harris would likely vigorously defend the plan in court, Dimino says.

Meanwhile, Trump is likely to support the dissolution of SAVE. “Certainly in a Trump administration, there would be every effort to enact regulations striking down SAVE, even if it were ruled constitutionally appropriate,” Meyer says. “This sort of regulatory whiplash happens with every presidential transition in nearly every area of policy where the parties disagree.”

Instead of SAVE and other existing income-driven repayment (IDR) plans, Project 2025 calls for a single IDR option that would generally increase monthly payments for borrowers relative to SAVE and other current options. It would also aim to remove the loan forgiveness option; under current IDR plans, borrowers can get forgiveness after 20 or 25 years of payments.

“While income-driven repayment (IDR) of student loans is a superior approach relative to fixed payment plans, the number of IDR plans has proliferated beyond reason,” the document says. “And recent IDR plans are so generous that they require no or only token repayment from many students.”

A family of four that earns $50,000 a year would have a $0 monthly payment under SAVE. But under the Project 2025 IDR plan, that family’s payment would be about $156 per month, Meyer says.

Public Service Loan Forgiveness

Teachers, doctors, firefighters, police officers, military members, government employees and and other nonprofit workers benefit from the Public Service Loan Forgiveness (PSLF) program, which erases your remaining federal student debt after 10 years of public service and 120 monthly student loan payments.