The 2024 presidential election features a major debate between Democratic nominee Kamala Harris and Republican nominee JD Vance over the child tax credit.

A Major Point of Debate in the 2024 Presidential Election

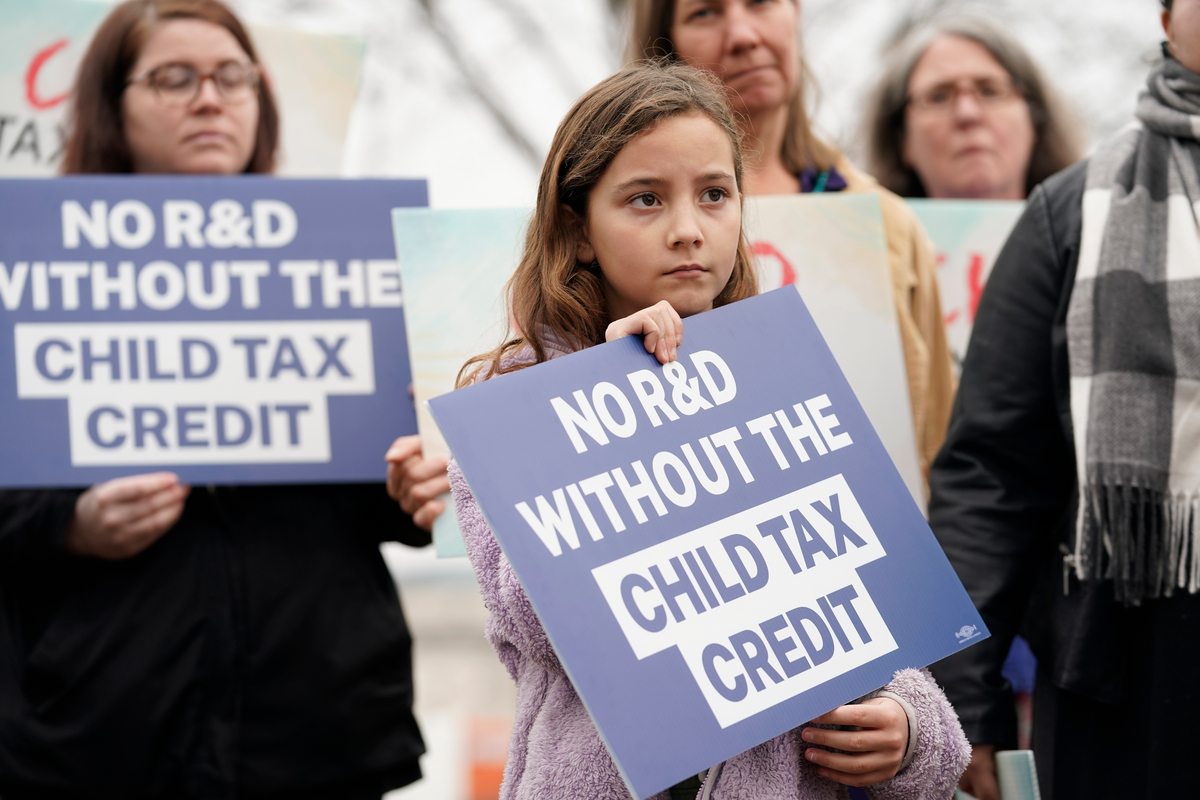

According to the report of CNN, in this year’s presidential election, the child tax credit is a big topic for both major parties. Democratic nominee Vice President Kamala Harris is focusing on expanding the child tax credit to help families with their costs. She wants to bring back the enhanced credit from the 2021 American Rescue Plan Act, which gave up to $3,600 per child. She also plans to add a new $6,000 credit for newborns. This plan aims to offer more financial help to families and is part of her larger platform on housing, groceries, and prescription drug costs.

On the other side, Republican vice presidential pick JD Vance supports a $5,000 child tax credit. This idea matches with former President Donald Trump’s past support for a large credit. Vance has not yet detailed how this would work but he suggests a universal approach with no income limits. Trump’s support for a big credit aligns with his earlier efforts to increase it during his first term. The costs of these proposals are high, with Harris’ plan expected to add $1.2 trillion to federal deficits over ten years and Vance’s plan possibly costing between $2 trillion and $3 trillion.

READ ALSO: Medical Debt Forgiveness: A Band-Aid Solution For A Wound That Won’t Heal

(photo: Bloomberg)

Candidates’ Plans for Child Tax Credits and the Economic Impacts

As the 2026 deadline approaches when the current credit will drop to $1,000, both candidates’ plans show the high stakes in deciding how to support families. Harris wants to build on the enhanced credit from the pandemic to offer more help, especially to lower-income families. Vance’s proposal is about a universal $5,000 credit that is easy to access. The financial impacts of these plans are significant ranging from $1.2 trillion to $3 trillion over a decade. This highlights the tough decisions and debates that will continue no matter who becomes president.