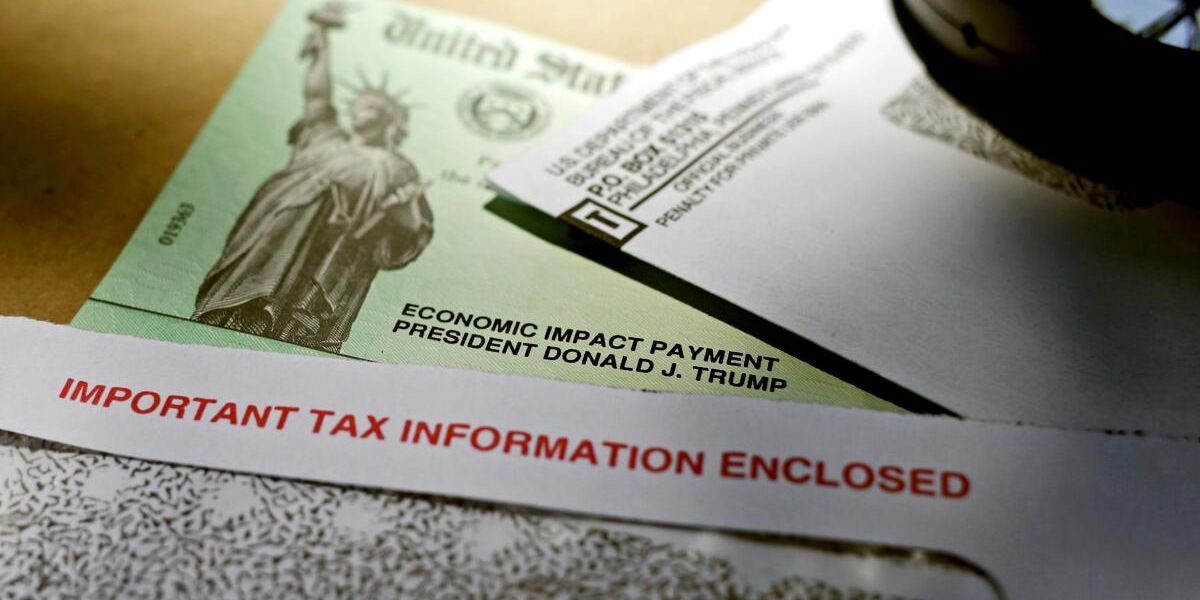

WPBN: The United States Internal Revenue Service (IRS) has initiated the process of distributing around $2.4 billion in stimulus tax credits that have not been claimed. It is estimated that around one million taxpayers who met the eligibility requirements but did not make a request for the credit during the fiscal year 2021 will get the benefits of this distribution.

For each individual beneficiary, an automatic payment of up to $1,400 may be made, either by an electronic transfer to bank accounts that were already registered or through a paper check that was sent to the address that was stated.

Taxpayers will not be required to complete any additional procedures in order to collect these money, as stated by the Internal Revenue Service (IRS).

How will the Internal Revenue Service (IRS) transmit your money?

Commissioner of the Internal Revenue Service Danny Werfel emphasized that the purpose of this approach is to make it easier to obtain tax benefits.

“We identified that one million taxpayers did not take advantage of this important credit despite being eligible,” Werfel stated. “To make the process easier, we are implementing automatic payments, eliminating the need for people to file amended returns.”

The three rounds of Economic Impact Payments that were distributed during the COVID-19 epidemic are represented by these funds. This automatic refund effort was initiated as a result of the findings of the third round, which was carried out in 2021. The findings revealed that a significant number of taxpayers had failed to claim the Recovery Refund Credit.

Eligibility requirements depending on tax results

Individuals who filed their federal returns for the year 2021 and either left the Recovery Rebate Credit line blank or entered a zero amount will be eligible to receive reimbursements automatically.

The information about their bank accounts that was included in their most recent tax returns will be used to make deposits using the year 2023 as the reference point.

The cash will be returned to the Internal Revenue Service (IRS) by the bank if the bank account that was provided is non-active. In these instances, a paper check will be generated automatically and mailed to the last registered address.

This will ensure that the beneficiaries receive their credits without the need for any additional procedures to be carried out.

Go Green and Save: Illinois Unveils $4K Rebate for Electric Car Buyers in 2025

Specifications for individuals who did not file their tax returns

The Internal Revenue Service (IRS) also noted that those who did not file a tax return in 2021 but believe they satisfy the eligibility criteria are able to claim the credit by filing their return prior to April 15th.

Applicants will be able to gain access to the funds that correspond to the Recovery Rebate Credit once this phase is completed.

For additional information regarding the procedure, the Internal Revenue Service (IRS) suggests that you visit its official website or seek the advice of a tax professional.

Parents in New York to Receive Up to $1,000 Per Child with Expanded Tax Credit

The purpose of this act is to guarantee that all taxpayers who are qualified for benefits are provided with those benefits in a timely and effective way according to their eligibility.

REFERENCE