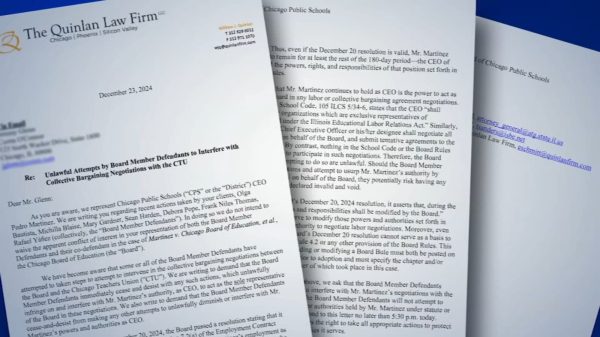

The federal child tax credit provides up to $2,000 per child under 17 for the 2024 tax year.

Maximize Your Child Tax Credit: Eligibility, Amount, and Filing Requirements

According to the report of Kiplinger, the federal child tax credit (CTC) provides significant support to many U.S. families by offering up to $2,000 per child under 17 for the 2024 tax year. Established by the 2017 Tax Cuts and Jobs Act (TCJA), this credit reduces your tax liability and can also deliver up to $1,700 per child as a refundable credit if your tax bill is less than the amount of the credit. For single filers earning over $200,000 and married couples earning over $400,000, the credit begins to phase out. This year, the refundable portion has been adjusted for inflation which benefits lower-income families who may not owe enough taxes to utilize the full non-refundable credit.

Eligibility for the child tax credit depends on various factors including the child’s age, residency, and the taxpayer’s income. To claim the credit you need to use Form 1040 and Schedule 8812 or the IRS Non-filer Sign-up Tool if you don’t usually file taxes. Families must have a minimum income of $2,500 per year to qualify with the credit increasing by 15% for each dollar earned above this threshold. This credit structure is designed to assist families across different income levels offering additional tax relief for those with multiple qualifying children.

READ ALSO: $10,000+ In Free Money: 5 Ways To Boost Your Finances – Must Know!

(photo: VIBES Noticias – OkDiario)

Will Congress Make Changes to Support Families?

Looking ahead, changes to the child tax credit are possible as Congress debates whether to extend or enhance it. The provisions of the TCJA which increased the credit to $2,000 and expanded eligibility are set to expire in 2026. Without new legislation, the credit will revert to $1,000 per child and apply only to children under 16. Recent efforts to expand the credit further have not been successful in Congress with proposals failing to pass. As the 2024 presidential election approaches, the child tax credit may become a focal point with candidates like Vice President Kamala Harris advocating for its expansion to alleviate child poverty and support families.

The future of the child tax credit remains uncertain with potential changes on the horizon after 2025. The ongoing debate in Congress marked by various proposals and stalled agreements, underscores the credit’s significance for families. If no new legislation is enacted, the credit will revert to lower amounts making it a likely major topic in the upcoming election and a critical element in discussions about tax policy.

READ ALSO: Big Bucks For Bank Of America Customers: $21 Million Settlement Unfolds