Tennessee families saved nearly $64 million in federal tax credits from the Inflation Reduction Act for home energy upgrades, though the benefits have been criticized for favoring wealthier households.

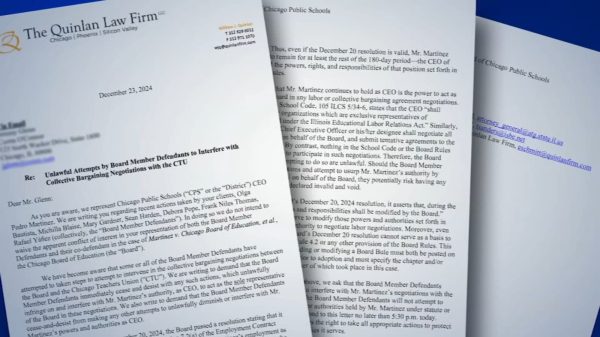

Tennessee Families Save $64 Million with Inflation Reduction Act Tax Credits for Energy-Efficient Home Improvements and Clean Energy Systems

According to Tennessee Lookout, in Tennessee, more than 45,000 families saved almost $64 million last year by making their homes more energy-efficient or installing clean energy systems like solar panels. These savings came from federal tax credits provided by the 2022 Inflation Reduction Act, which helps people lower their energy bills and reduce pollution. Across the country, over 3.4 million households received a total of $8.4 billion in these tax credits, according to recent IRS data.

The tax credits were available in two main types: clean energy and energy-saving home improvements. In Tennessee, about 9,700 people received around $30.3 million in credits for clean energy, averaging $3,110 per family. Another $33.7 million was given for home energy improvements like better insulation and efficient windows, with each household saving an average of $902. These incentives encourage people to invest in greener, more efficient homes.

READ ALSO: $10,000+ Unclaimed Cash: Orange County Residents Urged to Claim Funds by September 1, 2024

$8.4 Billion in Tax Credits: How Tennessee Families Saved Millions by Going Green – But Critics Question Equitable Distribution (PHOTO: French Brothers)

Criticism Arises Over Inflation Reduction Act Tax Credits Favoring Wealthier Households in Tennessee

However, some people have criticized the system for giving more benefits to wealthier households. A report by Politico’s E&E News showed that people making over $100,000 a year received most of the tax credits in 2023, even though they make up a smaller portion of taxpayers. Those earning less than $100,000 got a smaller share of the credits, raising concerns about fairness in how these benefits are distributed.

READ ALSO: Up to $14,000 in Rebates: Inflation Reduction Act’s Home Electrification Program Saves Americans Thousands on Energy Costs!